Finance Bill, 2024: State backs down on controversial proposed taxes after public outcry

The committee has recommended the deletion of the 2.5 per cent proposed Motor Vehicle Tax saying the tax is discriminatory and non-progressive.

As the National Assembly Finance and National Planning Committee prepares to table the Finance Bill, 2024 report in parliament for the second reading on Tuesday, the House team dropped several controversial proposals in the Bill after gathering various views during the public participation exercise that closed last Monday.

Motor vehicle tax

More To Read

- From detention to global recognition: Rose Njeri named in 2025 Time100 Next list

- The impact of the recent Finance Bill on different sectors

- How protests over Finance Bill hurt Nairobi’s daily revenue collections

- 16 killed in June 25 memorial protests, most by police – Amnesty International

- We are forgotten: Erickson Mutysia’s mother makes heartbreaking plea for justice

- Fury as plainclothes police camp outside Rongai artist Matiri's home without warrant ahead of protests

The committee has recommended the deletion of the proposed 2.5 per cent motor vehicle tax, saying the tax is discriminatory and non-progressive.

“The proposal to cap the levy at one hundred thousand shillings makes the tax unfair and it will have adverse effects on the insurance-taking behaviour of motor vehicle owners and further lead to negative effects on the insurance sector,” the committee noted.

"Commercial vehicles are subject to advance tax and therefore, imposing this tax will amount to double taxation. From the foregoing, the Committee recommends the deletion of the proposed motor vehicle tax."

Bread tax

The Committee has recommended repealing the 16 per cent VAT on bread saying that if the tax is imposed, it will make the basic commodity less affordable, beyond the affordability of many Kenyans.

"The Committee observes that bread is a basic commodity used in many households and imposing VAT on it would increase its cost beyond the affordability of many Kenyans," National Assembly Finance and National Planning Committee Chairman Kimani Kuria said.

"The Committee proposes to zero rate ordinary bread, unleavened bread, gluten bread, inputs and raw materials supplied to manufacturers of agricultural and pest control products, agricultural pest control products, transportation of sugarcane from farms to milling factories, supply of locally assembled and manufactured mobile phones, among others."

The Committee further proposed exempting several products from VAT, including the issuing of credit and debit cards, foreign exchange transactions, sanitary towels and diapers and services of local film agents.

Eco levy

The new environment tax has been backed by the committee citing reasons to strongly continue with the fight against environmental pollution.

However, it has recommended to exemption all locally manufactured products to protect local manufacturers who are currently subjected to Extended Producer Responsibility (EPR).

Instead, all imported finished products will be subjected to the tax.

The Committee proposes to remove the imposition of the levy on diapers, tyres of motorcycles, bicycles, wheelchairs and three-wheeled motorized vehicles (tuk tuks).

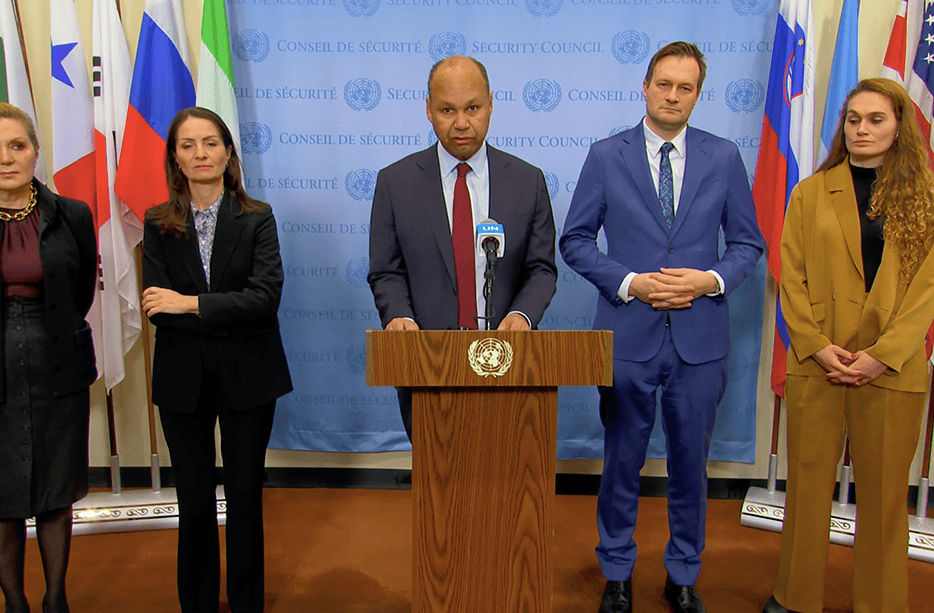

National Assembly Finance and National Planning Committee Chairman Kimani Kuria addresses the press on the Finance Bill, 2024 at State House, Nairobi on July 18, 2024. (Photo: PCS)

National Assembly Finance and National Planning Committee Chairman Kimani Kuria addresses the press on the Finance Bill, 2024 at State House, Nairobi on July 18, 2024. (Photo: PCS)

e-Tims

The Committee proposes to exempt subsistence farmers and micro enterprises whose gross turnover is below Sh1 million from e-Tims registration.

It further recommends the issuance of guidelines by the Kenya Revenue Authority (KRA) on the operationalization of this proposal.

This is in a bid to cushion the producers at the bottom of the economic pyramid.

Timeline for remitting excise tax

In a bid to protect manufacturers from cash flow challenges stemming from the requirement to remit excise tax within 24 hours, the committee has recommended changing the period to remit to "by the 5th of every month."

The Committee notes that the requirement to remit excise tax within 24 hours has led to cash flow problems for compliant licensed manufacturers.

In a further move to protect local manufacturers, the committee has recommended to exempt from excise duty on vegetable oils, fertilised eggs from incubation and clinker.

In addition, the Committee has proposed to reduce the rate of excise duty for imported sugar confectionery and spirits of undenatured ethyl alcohol.

Further, in keeping with the tax system's predictability, the Committee has proposed to maintain the current rates of excise duty on imported motorcycles, plastics, onions, and potatoes.

Digital money transfer tax

With regards to excise duty in services, the Committee has proposed to maintain the prevailing rate of money transfer services by banks and financial institutions and money transfer services by cellular phone service providers.

The Bill had initially planned to raise excise duty on mobile transfer agencies from 15 per cent to 20.

Import declaration fee

The Committee has backed the proposal to increase the import declaration fee from 2.5 to 3.5 per cent.

It notes that the reduction of the rate of the fee from 3.5 to 2.5 per cent in the Finance Act, 2023 occasioned a significant revenue loss amounting to at least Sh10 billion, hence hurting the implementation of the FY2023/24 budget.

"The proposed increase of IDF to 3.5 per cent would therefore help to restore the performance of this tax head in line with projected budget estimates for FY2024/25," Kimani said.

Other notable highlights

The threshold for VAT registration has been increased from Sh5 million to Sh8 million. This therefore means that many small businesses will no longer need to register for VAT.

Excise duty imposed on imported table eggs, onions and potatoes to protect local farmers.

On the other hand Excise duty on alcoholic beverages will now be taxed on the basis of alcohol content and not volume.

The higher the alcohol content the more excise duty it will attract. Consequently, alcohol manufacturers are expected to make safer and cheaper alcohol.

Pension contributions exemption to increase from Sh20,000 per month to Sh30,000.

Top Stories Today